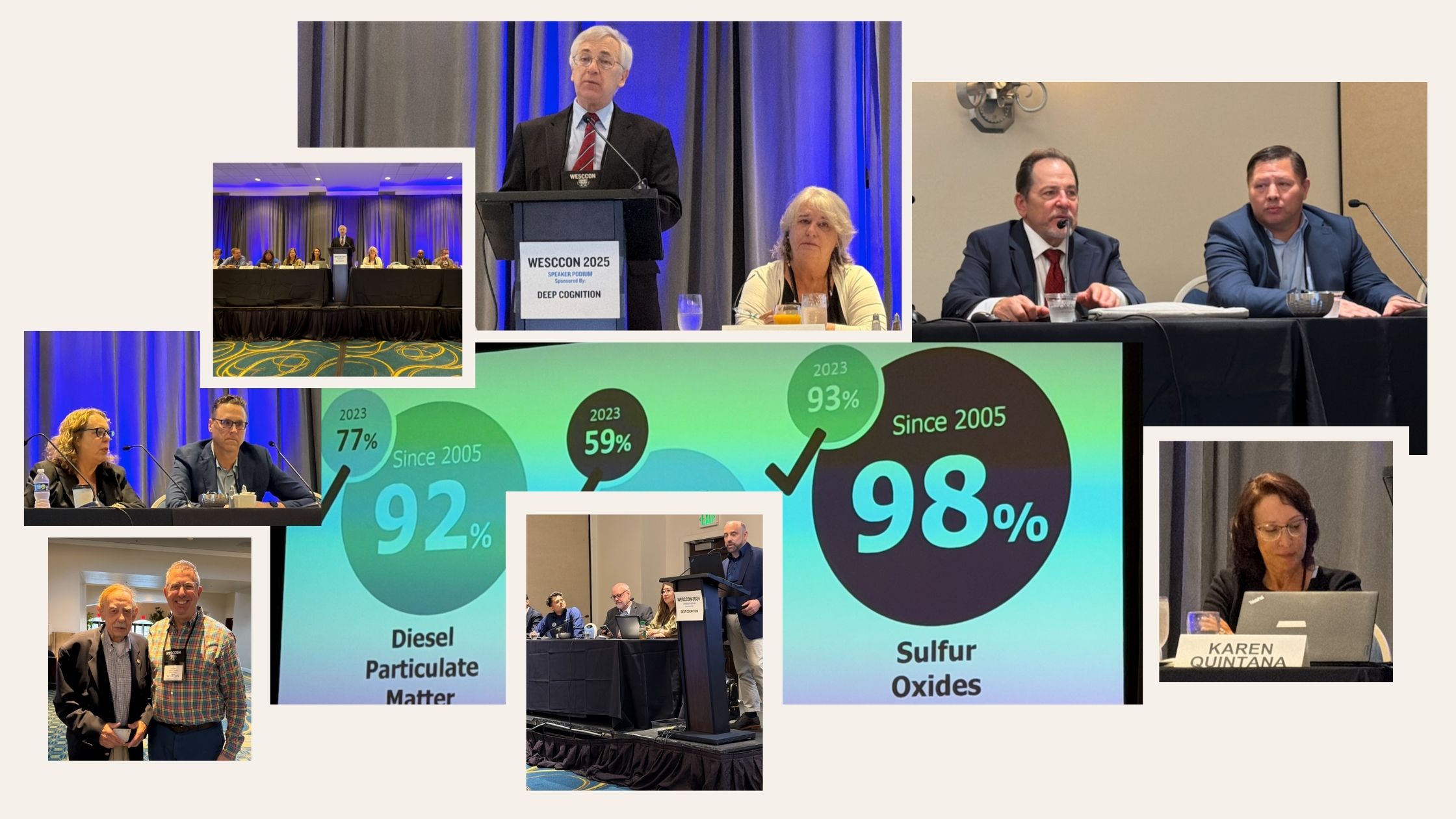

There are few events I enjoy attending more each year than WESCCON and it’s a testament to the volunteers within the Pacific Coast Council and the local associations up and down the west coast of the United States that make it happen. It’s a jam-packed, hard-hitting, content-laden, morning-to-the-late-night event that offers the best of education, networking, and frivolity.

The government shutdown happening while the conference was in session meant that the usual participation from port directors and regulatory agencies wasn’t possible, and the private sector picked up the slack in their absence. I mean, if you’re a customs broker or freight forwarder right now, there’s plenty to talk about, commiserate over, and share best practices; because everyone’s in the same foxhole.

In no particular order, here are my biggest takeaways.

Revenue Collection is Up – De Minimis is Down – Enforcement is Automated

CBP’s enforcement and collection statistics presented during one panel showed that total duties, taxes, and fees collected skyrocketed from $88.07 billion in FY 2024 to $195.9 billion in FY 2025—a 122% increase driven entirely by the new tariff regime. Entry summaries filed jumped from 38.3 million to 43.1 million, while audit recoveries climbed from $117.67 million to $192.77 million as CBP intensified its scrutiny – and that figure is only going to continue to climb for the foreseeable future.

Unsurprisingly, following the suspension of “legacy” de minimis on August 29th, Section 321 de minimis entries fell in FY 2025 from the preceding year – from 1.36 billion to 945.3 million—a 30% drop. ICYMI, Logistically Speaking’s first episode of its third season covers this very topic.

Multiple presenters made reference to their belief that CBP has significantly increased their deployment of AI and automation tools based both on the number of CF-28s and seemingly instantaneously-issued CF-29s the trade is receiving.

Brokers need to communicate to importers that the old school way of picturing an import specialist in a CEE poring over entries and finding questionable classifications and valuations before issuing those 28s is a relic of the past. Analysis is happening rapidly and automatically, and this near real-time checking by CBP is yielding many more trade inquiries.

Demurrage, Detention, Drayage and the FMC

The Federal Maritime Commission dominated several discussions following the recent Court of Appeals decision in FMC v. World Shipping Council, which partially set aside the FMC’s 2024 demurrage and detention billing rule. The court found the FMC’s approach “arbitrary and capricious” because while the rule was designed to limit billing only to parties with contractual relationships to the billing party, it inexplicably excluded motor carriers who do have such relationships while seemingly including consignees who may not.

For now, most ocean carriers are maintaining their current billing practices—sending invoices to the contractual party rather than truckers—while they await clarity on next steps. But the uncertainty has created tension in an already strained system, and truckers remain concerned about reverting to the pre-rule environment where they were billed for charges beyond their control.

NVOCCs must continue to adhere to the rules passed in OSRA 2.0 and the importance of documenting dates and details to provide protection down the road has never been more important.

Cargo Theft is On the Congressional Radar

Cargo theft emerged as a major concern, evolving from opportunistic crime to sophisticated organized fraud. Panelists described schemes involving fictitious pickups, identity spoofing, and strategic facility breaches where criminal syndicates create fake carriers, replicate legitimate company documentation, and intercept high-value loads.

Peter Schneider, Executive Vice President of IMC Logistics, detailed two significant pieces of legislation making their way through Congress to address the crisis. The Household Goods Consumer Protection Act (HGCPA), introduced in January by bipartisan senators, passed unanimously in the Senate in May and is now moving through appropriations. The bill beefs up the Federal Motor Carrier Safety Administration’s authority to identify and penalize bad actors, eliminates the dual DOT/MC number system in favor of a single DOT number, and prohibits P.O. boxes as business addresses to combat the fraud schemes where criminals obtain dozens of legitimate carrier numbers.

The second bill, the Combatting Organized Retail Crime Act, or CORCA, establishes a federal cargo theft task force under Homeland Security that provides grant funding to state and local law enforcement while creating a supply chain advisory group—bringing together industry experts with law enforcement to improve training and prosecution of these crimes, which currently cost the industry $6.6 billion annually with only 26% of stolen cargo ever recovered.

Controversial Takes on AI and Entry Writers

Perhaps the most transformative discussion centered on artificial intelligence. Panel after panel explored how AI is fundamentally changing the customs brokerage profession. The technology now reads documents in multiple languages, suggests HTS classifications with supporting CROSS rulings, performs duty calculations including complex tariff stacking, flags discrepancies between different data sources, and handles much of the clerical work that has defined “customs business” for decades. The consensus was striking: brokers must evolve from data entry clerks to strategic trade advisors who leverage AI tools, or risk at best irrelevance, at worst, obsolescence.

One presenter captured the generational shift perfectly: entry writers are becoming entry reviewers – maybe even only entry submitters, and brokers are spending less time on paperwork and more time on consultative work with clients.

There were other topics covered that I may blog or write about on LinkedIn – connect or follow me if you’re not already – including a keynote from S&P Global’s Paul Bingham with a sobering economic forecast, the annual West Coast ports panel, and best practices for both brokers and forwarders with PGAs, CBP, the FMC, and other agencies.

The Need To Communicate Has Never Been Stronger

Brokers and forwarders communicate and use each other as resources. They rely on and receive great guidance and education from local and national associations and a constellation of technology, surety and legal vendors.

What they need to focus on more, though, is customer-facing communication. The endless fusillade of rules changes that come from the government affect both them and their customers. While they’re busy trying to figure out how to program, train and ensure entries are filed timely and compliantly, they need a partner like Position : Global who is already following the Executive Orders, CROSS rulings, CSMS messages, and Federal Register notices and understands the issues at hand.

P : G can quickly synthesize and distill what is being said and directly asks our clients the question, “So how will you solve this for your shipper clients.” That personalization from each of those companies is what makes them unique to their ideal customers, and makes Position : Global the bespoke choice for their all-important client-facing communications.