At the Traffic Club of Chicago’s Transportation & Logistics Customer Forum, Bill Cassidy, Senior Editor of the Journal of Commerce, delivered a keynote that offered a comprehensive analysis of current economic trends impacting the industry.

Economic Outlook: Slow Growth and Uncertain Signals

Cassidy’s insights pointed to a forecast of slower economic growth in the coming years, with discussions suggesting no recession in 2024. He raised a pertinent question about whether the prevailing conditions would lead to a reset or a rebound, indicating a probable reset by 2024 transitioning into 2025.

Interpreting Mixed Economic Indicators

The keynote delved into economic indicators, highlighting a projected growth of 2.5% in 2023, which is expected to taper down to 1.6% in 2024. Cassidy shed light on some conflicting signals within the economy, noting higher imports in September compared to a prosperous year in 2018.

Analysis of Economic Health Metrics

Cassidy discussed various metrics indicating economic health. He noted a recent uptick in new orders in October after a six-month lull, despite diminishing backlogs. The Purchasing Managers’ Index (PMI) stood at 50, indicating a neutral position—neither contraction nor expansion.

Market Dynamics and Trade Trends

The discussion covered inflation trends, signaling a decrease, and a resilient labor market boasting a 3.9% unemployment rate. Insights into the for-hire trucking index, although down, surpassed 2019 levels, providing a nuanced perspective on the industry’s performance.

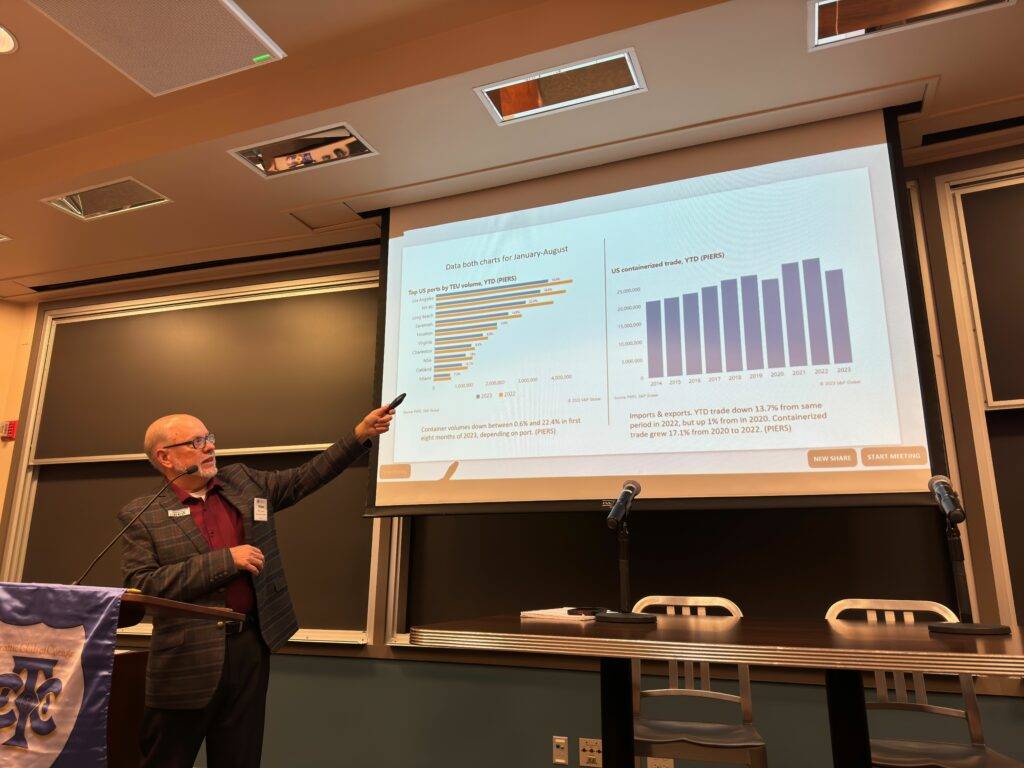

Trade Fluctuations and Outlook

Examining trade statistics, Cassidy highlighted a Year-to-Date trade decrease of 13.7% from 2022 but an increase of 1% from 2020. He also noted a significant 86% decline in ocean freight, indicating an anticipation of worsening market conditions.

Paths to Economic Reset

Cassidy outlined various routes toward a potential economic reset. He mentioned truckload dynamics showing gradual recovery and heavy truck production, which experienced a 5% increase in 2023, primarily utilized by smaller carriers and private fleets. However, projections suggested a potential 12% downturn in production for 2024.

Shifts in the Industry Dynamics

An interesting observation was the discrepancy in recovery between larger and smaller carriers. Larger carriers have yet to recover from the Great Recession and remain at 2006 levels, while smaller fleets have witnessed substantial growth, altering the industry landscape.

In Conclusion

Bill Cassidy’s keynote offered a detailed exploration of economic trends, providing attendees with valuable insights into the current state of the transportation and logistics sector. His analysis sets the stage for attendees to navigate the evolving economic landscape with informed perspectives and adaptable strategies.

Overall, the keynote served as a valuable guide, enabling industry stakeholders to comprehend and respond effectively to the changing economic nuances influencing transportation and logistics operations.

Interested in learning more? Get in touch.